How We Work

We provide:

- Bespoke financial planning tailored to your specific requirements, reviewed and modified over time

- The benefit of our years of experience and knowledge

- Independent research and efficient administration backed up by the latest technology

Advice Options

We offer the following advice options:

Full advice - comprehensive financial review based on all aspects of financial planning

Focused advice - certain aspects of financial planning, as specified and agreed with you

Execution only - for one off transactions instructed by you

Full Advice – a 'Comprehensive Plan'

We aim to provide all our clients with full and comprehensive advice rather than limiting it to one aspect or product. This means that we will consider how all your plans and investments overlap and interact with one another in order to formulate the most efficient strategy for your needs. This is often summarised as “holistic” planning.

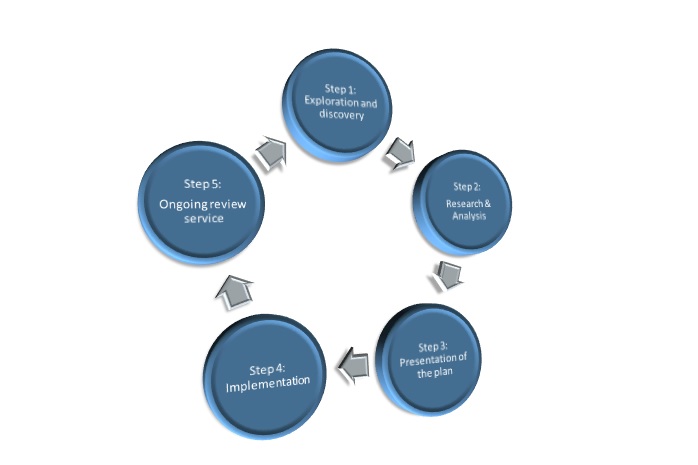

To provide comprehensive financial planning and wealth management advice, we follow a 5 step comprehensive and robust process as follows:

Step 1: Exploration & Discovery

Initial Consultation

Provided without charge to discuss and gain an understanding of your financial planning requirements and objectives, together with an overview of your current circumstances. There is no obligation to proceed further should you not wish to, or if it is established that we are unable to be of service to you at this time.

Fact Find

Assuming you wish to progress further, the next step is for you to provide us with full details of your current personal and financial circumstances via completion of a confidential ‘fact find’. This is an important part of the planning process as this information will form the basis of our advice and recommendations.

Step 2: Research & Analysis

Once the fact find is complete, we will summarise our understanding of your circumstances, confirm your needs and objectives and any priorities, together with our suggested next steps toward a tailored and realistic planning solution, including the likely costs.

We will then begin the process of analysing any existing provisions you have in relation to your current position, goals and objectives, and research potential solutions for your needs based on our extensive knowledge of financial markets. Where we need to obtain additional information from the providers of your existing provisions, or from other professional advisers, will obtain your signed authority to do so.

We will also discuss your attitude to investment risk and your understanding of how such risk may affect you and your goals, including completion of a risk profiling questionnaire which is specifically designed to help establish and confirm your individual risk level and requirements.

Step 3: Presentation

When we have all the information we require and the research and analysis is complete, we will arrange to meet with you to discuss our recommendations for the planning solutions we believe to be in your best interests. We will also include details of any costs that are involved in addition to our advisory charges. Our advice and recommendations are always confirmed in writing prior to the implementation of any services or products, usually in the form of a detailed report.

Step 4: Implementation

Once you feel that you are in a position to make a fully informed decision to proceed, and you have given us your consent to do so, we can begin the process of implementing our agreed recommendations. Where this involves the purchase of any financial products, such as a pension plan or investments for example, we will assist you in completing all the application forms and associated paperwork to ensure everything is processed by the relevant providers in a timely manner.

Step 5: Ongoing Review Service

This service is optional, but whether you have a sizeable and complex portfolio of products, or one or two modest investments, it is important to consider how these should be managed going forward. We can provide an ongoing review service designed to expertly maintain and monitor your wealth assets.

The benefit of this is to ensure that your objectives and attitude to risk are correctly aligned with your holdings over an extended period. In addition, an ongoing advice service ensures that any developing and future financial objectives are considered. Aspects of your financial arrangements can change over time, including your goals and risk profile, as well as the underlying asset’s risk characteristics. This review service can help adapt and position your arrangements to manage such changes and influencing factors.

Charges

You will always know our charges before you decide to proceed. We have a transparent charging structure and are committed to ensuring our services and charges represent excellent value for money.

Our charges are based wholly upon the provision of qualified and professional expertise, the time taken to analyse your circumstances and devise an appropriate strategy going forward, including a summary report to communicate and confirm any recommendations made to you. Fees also take account of our firm’s exposure to regulatory, commercial, and financial risk.

Full details of our charges, both initial and for ongoing servicing (where applicable) and the options for payment are detailed in our Service Charter (available on request) and will be discussed and agreed with you prior to commencing chargeable work.

Hamblin-Martin Financial Ltd is an appointed representative of Best Practice IFA Group Ltd which is authorised and regulated by the Financial Conduct Authority (FCA). Hamblin-Martin Financial Ltd FCA No: 711323. Registered Office: Sterling House, 27 Hatchlands Road, Redhill, Surrey. RH1 6RW.

Hamblin-Martin Financial Ltd. Registered in England and Wales No. 9630529.

The Financial Ombudsman Service (FOS) is available to sort out individual complaints that financial services businesses and their clients are unable to resolve. To contact FOS please visit: www.financial-ombudsman.org.uk.